Italy’s ceramic machinery and equipment suppliers increase turnover by 26.2%

The Italian manufacturers of ceramic machinery and equipment reported 26.2-% growth in turnover for 2011. According to a survey conducted by Acimac, the sector generated a turnover of € 1.738 bill., recovering 94% of the losses suffered since 2009. This excellent performance has put the sector ahead of all Italian capital goods manufacturers.

The recovery was driven primarily by exports, which accounted for 79.8% of turnover. The sector’s level of internationalization is also increasing. In 2011 there were a total of 53 companies majority-owned by Italian groups (share greater than 51%) operating outside Italy. These companies generated a turnover of € 550 mill. Adding these volumes to the total turnover generated in Italy, the sector reported an all-time record turnover of € 2.297 bill. The Italian market also showed an initial recovery, closing 2011 with 9.2-% growth.

The number of companies also continued to fall, although the average company size is gradually increasing. The number of employees rose to 6 343.

For 2012, Acimac is cautious owing to a slowdown in growth in almost all the world’s economies, even in India and China, as the outgoing chairman Pietro Cassani stressed. Initial estimates for 2012 suggest that the turnover levels reached at the end of 2011 could be maintained.

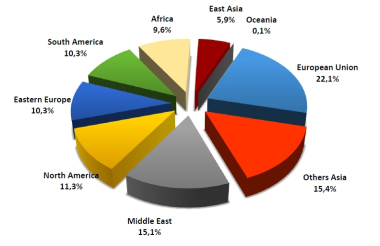

Exports drive the recovery: + 31.3%

In 2011 the sector’s Italian companies consolidated their shares of international markets.

The Middle East was the largest outlet market, accounting for 20.5% of export turnover (€ 284 mill.). In second place came the European Union (€ 233.3 mill. = 16.8% of the total). This was followed by Asia (€ 215 mill. = 15.5%), then South America with 11.9%. East Asia (China, Taiwan and Hong Kong) dropped in the rankings with a 19.4% fall in turnover and an 11.8% share of total exports. Eastern Europe saw a 50-% rise in turnover (8.9% of the total), while Africa held just a 7.8% share. North America and Oceania occupied the last two places (6.6% and 0.3% of the total respectively) but showed strong turnover growth (116% and 321.4% respectively).

Italian market picking up again

With a turnover of € 350.3 mill. (20.2% of the total), the Italian market also showed positive growth by 9.2%. This marked a sharp trend reversal in respect of the previous three years (- 4.6% in 2010), although the figures still fall far short of pre-crisis levels (-28.5% on 2008).

Fewer companies, more employees

At the end of 2011 there were 150 companies operating in the ceramic machinery and equipment manufacturing sector in Italy, (2010:157). The largest contraction (-11 companies) was in the category of small enterprises (turnover below € 2.5 mill.). By contrast, companies with turnover in excess of € 10 mill. increased by 3 to reach a total of 19 companies.

The number of employees rose by 115, to 6 343. The number of executives and company owners fell by 27, while the number of technical and production professionals rose by 141. The profitability per employee rose in step with growth in company size.

Machine group: shares of turnover

The shares of turnover generated by the various types of machines remained fairly stable in 2011 as they reflect the importance of these machines within the ceramic production process.

Machines for shaping ceramic materials accounted for 24.4% of turnover, followed by glazing and decoration machinery (17.8%), firing technology (15.1%) and raw materials preparation machinery (9.7%), storage and handling machinery (8.1%) and finishing technologies (6.8%), followed by moulds (5.7%).

Most types of machines generated exceptional turnover increases. Firing and shaping machines grew respectively by 58.9% and 21.7%, drying machines by 33.7%, storage and handling machines by 25.2%, and raw materials preparation machines by 18.1%. The turnover generated by the sale of classification systems almost doubled, up by 87.1%.

Other types of machines showed smaller increases, particularly moulds with just 8.2% owing to their strong dependence on the Italian market, which contracted by 4.7% for this product type.

The only type of machine to experience a fall in turnover was that of quality and process control machines, which experienced a 72-% contraction (although following the boom of 2010 this figure is no cause for alarm).

Client sectors

The breakdown of turnover by client sectors remains similar to that of previous years.

The largest share of total turnover was generated by supplies to tile manufacturers, which made up 80.3% of total turnover (80.8% in 2010). Sales to tile manufacturers rose by 25.4% to a total of € 1.396 bill. Exports played a crucial role, totalling € 1.089 bill. (+ 28.4%). Growth was more limited in the Italian market, reaching just 15.7% and in any case 19.6% down on turnover levels of 2008.

Turnover generated by sales to the second largest client sector, that of brick and tile producers, remained virtually stable, with a turnover of € 135.7 mill., 7.8% of total turnover, almost all of which was generated by exports (86.1%). These rose by 12.1%, compensating for the sharp fall in the domestic Italian market (- 32.2%).

Next came the market for various ceramic machines with € 65.2 mill., consisting of 88.2% exports, and that of sanitaryware machinery with € 61.6 mill. (+ 22.5%).

Machinery for the production of refractories totalled a turnover of € 51.9 mill., while the tableware and ornamental ware machinery sectors (€ 27.4 mill.) experienced 62.5-% growth in exports and a 66-% fall in Italian sales.