2017 – another record year for Italian ceramic machinery

“This is the fifth year of steady growth …”, said Acimac’s Chairman Paolo Sassi. Exports, which accounted for 74 % of total sales, were crucial to achieving these results. In 2017, exports totalled € 1.656 bill. (+7.1 %).

The Italian market

However, the best performance was in the Italian market with 20.6 % growth to a total of € 580.6 mill. “The incentives of the government’s Industry 4.0 Plan drove investments on the part of our Italian clientele …”, said Sassi, „…we expect to see the market return to normal over the next few years.”

Exports

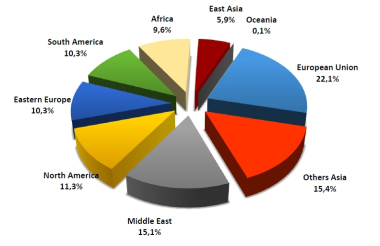

The largest area of export was the European Union with a turnover of € 431.5 mill. (26 % of total turnover), 26.2 % up on 2016. In second place was Southeast Asia with 14.7 % growth to € 273.3 mill. (16.5 % of total turnover), followed by the Middle East, which remained stable at € 230.9 mill. (13.9 % of total exports). Africa climbed a few positions in the rankings to fourth place with € 169.1 mill. (+13.8 %). South America was close behind with 6.2 % growth to € 168.6 mill. By contrast, the North American market saw a 19 % fall to € 141.1 mill. Eastern Europe also experienced a 15 % contraction in investments to € 134.7 mill. Sales to China enjoyed double-digit growth (+20.4 %) to € 103.8 mill. Closing the rankings was Oceania with € 3.6 mill., 3.3 % up on 2016.

Along with exports, a total turnover of almost € 500 mill. was generated by the 76 companies operating outside Italy but controlled by Italian groups.

Client sectors

The breakdown of turnover by client sectors remained almost identical to that of previous years.

Tile machinery was once again the largest sector accounting for 86 % of total turnover (+13.2 % to € 1 927.1 mill.). The second most important client sector was brick and roofing tile machinery, which, however, continued to experience significant difficulties with a further 18.1 % contraction in turnover to € 125.1 mill. Refractory machinery remained in fourth position with a turnover of € 40.1 mill. (+15.7 %).

Forecast for 2018

The outlook for the current year is cautious, Sassi expects turnover will remain unchanged in 2018.

Acimac

www.acimac.it