28.02.2009: VDMA: 2008 Indicates The End Of The Boom for Construction Equipment And Building Material Machinery

Lack In Orders Increasingly Worrying

Frankfurt, Main/Germany, February 24th, 2009 – The period of extraordinary growth in the construction equipment and building material machinery industry, which lasted for six years in a row, has now come to an end. „Never before have we seen such a sudden and drastic decrease in incoming orders happening at so many companies, in so many different sectors and markets at the same time as in the last quarter of 2008”, said Mr Dr Christof Kemmann, Chairman of the industry’s association which is part of VDMA, the German Engineering Federation, at a board meeting of the association in Frankfurt/Germany.

Decrease With Incoming Orders In The Fourth Quarter Of The Year

Incoming orders between October and December 2008 show a decrease by more than 30 per cent in total compared to the very high figures of the same period in 2007. This hit the manufacturers of construction equipment the most. The fact that clients are feeling more and more unsure, funding is increasingly becoming more difficult worldwide and projects are being postponed, have come to full effect on the construction equipment and building material machinery industry.

Sales Development In 2008 Overall Satisfactory

In total, the industry is still very content with the sales achieved in 2008. German manufacturers of construction equipment, building material, glass and ceramics machinery saw a growth in turnover by yet another seven per cent to 16.4 billon Euros in 2008, compared to the previous year. Construction equipment machinery made 11.1 billion Euros of this amount, whereas building material, ceramics and glass machinery made 5.3 billion Euros. This means that the turnover in construction equipment machinery remained the same, whereas building material, glass and ceramics machinery yet again saw a significant growth to their sales compared to 2007. This increase was mainly in their export sales.

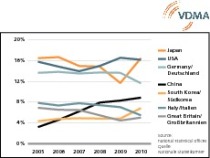

Competitive Position Remains Good

Mr Kemmann does not think the currently difficult situation is due to a structural problem of his industry. On the contrary, companies more than doubled their turnover (+ 113 per cent) in the past six years – which had been six years of growth in a row.He stressed that the companies could even cope with a slowdown in sales of little more than ten per cent. Despite the crisis, the German construction equipment and building material machinery industry still has a very good competitive position internationally. There are still opportunities for growth regionally as well as technologically. The demand of construction work worldwide keeps on being high, for instance with regard to infrastructure projects. Companies are convinced that their clients will start ordering again as soon as the current situation of retention is over and confidence in investors and banks is re-established. As the construction industry tends to be an earlier starter within the economic cycle, the construction equipment and building material machinery industry is likely to profit from these trends as one of the first industries. According to Mr Kemmann, this is exactly the reason why the construction sector is a very good tool for active economic stabilisation policy.

Manufacturers Of Construction Equipment Awaiting “Positive Effects By The Economic Stimulus Plans”

The construction equipment machinery industry is very happy to see the economic stimulus ‘packages’ the German government offers; especially the additional funds made available in 2009 for public investments in infrastructure projects as well as measures aiming at accelerating the allocation of construction work and permits. With this in particular, it is ensured that tax money is well spent as there will be material assets in return. The construction industry, which depends so much on export activities, is very happy to see that money is invested in export financing. It is said that this is a very good sign and leading in the right direction.

Forecast 2009

The association’s experts on the economic development of the industry expect the current orders at hand to be totally fulfilled in the course of this year. This will go together with a steep decrease in turnover. The construction equipment machinery industry will be hit by this slump more severely than the building material, glass and ceramics machinery industry.This is because the latter, as well as suppliers of very specialized machinery and niche products, still have a very high amount of orders already placed. Due to this, they see the current year as being stable. The forecast for manufacturers of construction equipment machinery in comparison is, therefore, significantly lower. They have been struggling with a low in incoming orders already since mid 2008. The situation is even more difficult, as dealers look at full stocks and therefore purchases do not have a direct effect on the manufactures of the products yet. Also the growing amount of suppliers becoming insolvent are adding to the difficulties.

Preserving The Jobs Of Permanent Staff

In the previous years of growth, companies required more staff. They fulfilled this need particularly by hiring temporary staff, as this allowed them to react more flexibly to fluctuation. Most companies now have to cut down on this staff. In the international construction machinery business, some renowned manufactures already had to lay off some of their permant employees as well. In many factories, staff is currently working short-time. All companies, which are members of the German Engineering Federation, are agreed that they want to try and keep their permanent employees also during this period of crises. It is said, though, that similar measures are, however, also likely in Germany, should the situation continue to get worse.

VDMA

Fachverband Bau- und Baustoffmaschinen

Lyoner Straße 18 I 60528 Frankfurt/Main IGermany

T +49 (0) 69 66 03 12 57 I F +49 (0) 69 66 03 22 57

www.vdma.org