VDMA Construction Equipment and Building Material Machines: light and shade

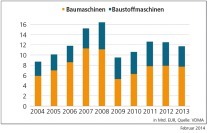

German construction equipment manufacturers are more optimistic at the middle of the year than they were at the beginning – "even though uncertainty is the largest obstacle for us at present," says Johann Sailer, Chairman of the VDMA Association for Construction Equipment and Building Material Machines. There has been double-digit growth in turnover by member companies throughout the sector in the first five months. Despite a damper in May, construction equipment manufacturers are therefore correcting their forecast upwards for 2015. An increase in turnover of 4 % to € 8.7 billion seems achievable. Building material facility manufacturers, however, are more sceptical. Many companies are on schedule, but large-scale orders are rare and fiercely competitive. "We therefore expect only to break even in 2015," explains Sailer. This is equivalent to turnover of € 4.3 billion. This would see turnover come to around € 13 billion for the whole construction equipment and building material machines sector in 2015.

Construction equipment: growth in Europe and North America

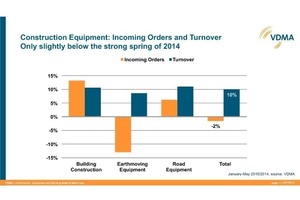

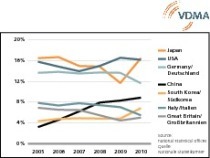

Construction equipment sales in Europe and North America have grown significantly in the first five months of the year despite the fact that the Russian market is in free fall, recording a decline of around 70 %. Even France, once the second largest construction equipment market in Europe, is suffering a pronounced downturn with an above-average decline of 19 % compared with the previous year. The drivers of business are the UK, Scandinavia and Germany. This year, manufacturers are expecting new momentum from Poland, too. Southern Europe is slowly catching up again. Nonetheless, Europe still has a recovery process ahead of it, "this is of central importance to us construction equipment manufacturers," stresses Sailer. The North American construction equipment market is doing well and has already reached the pre-crisis level of 2006. Therefore, the sector expects development next year to be rather flat. Good growth is coming from Saudi Arabia and the Emirates. China, India, Southeast Asia and Latin America, in particular, are falling short of expectations. When categorised by product group, there are significant differences in development. While demand for earthmoving machinery is somewhat disappointing – heavy machinery in particular currently has few customers due to the global mining crisis – the trend is continuing upwards in concrete technology. The current situation is still good in road construction machinery, too. After a strong start to the year, incoming orders throughout the sector are currently at minus 2 % compared with the previous year. However, turnover is clearly positive.

Building material facilities: companies have to live within their means

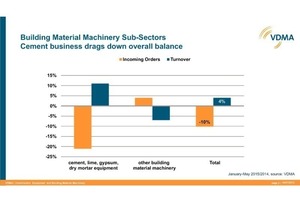

After a brief interim high, the order situation for building material facilities is currently becoming gloomy again. The reasons are many: Above all, companies are feeling the effects of orders from the Russian market, which is extremely important for many companies, that have fallen through – sometimes to the tune of up to € 80 million. The merger of the two industry leaders in the production of cement, Lafarge and Holcim, has also thrown the industry into turmoil and caused an investment backlog. Large-scale projects and identifiable growth markets are lacking worldwide. While there may be many projects, fewer and fewer of them are actually implemented. "And everyone is vying for the few that do materialise," explains Sailer. The playing field is becoming smaller. For building material facility engineers to compete with confidence in the future, too, they need more orders, he adds. In addition to Russia, the markets in Southern Europe and South America are currently causing difficulties. In contrast, Scandinavia, the Middle East and Southeast Asia are providing impetus. The fact that many companies have diversified and are supplying facilities in various industries is also having a positive impact on the order situation. However, at the end of the year, building material facility manufacturers will only break even.

Companies today are looking forward to 2016 with optimism. bauma will take place in Munich from 11 to 17 April. Every three years, the world's leading trade fair for the industry is considered a driver of new investments from customers worldwide.

VDMA

www.vdma.org