Italian Brick and Ceramics Industry with bleak outlook due to insecure gas supply

The Italian Brick and Tile industry shares the problems of the whole ceramics industry in the country. Regarding production and sales figures, 2021 proved to be a solid, in certain sectors even an exceptional year. However, future possible gas shortages and the prospect of soaring production costs make for a grim outlook in 2022. While demand for products is holding strong, paradoxically there is „a supply side crisis of unimaginable proportions“.

At ist General Meeting held on 14 July, Confindustria Ceramica presented its 2021 statistical surveys for producers of ceramic tiles and slabs, sanitaryware, porcelain and tableware, refractory materials, technical ceramics and bricks and roof tiles. The industry consists of a total of 263 companies operating in Italy with 26,537 direct employees and a turnover of EUR 7.5 billion, while Italian-controlled companies located in Europe and North America posted sales revenues of more than EUR 900 million.

The Meeting, which elected the Chairman and Vice-Chairmen for the two-year period 2022 - 2023, also featured a remote speech by Manlio di Stefano, Undersecretary at the Ministry of Foreign Affairs and International Cooperation.

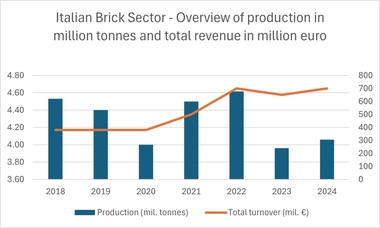

According to the reported figures, the Italian brick and tile industry consists of 62 companies with a workforce of 3,000 employees and revenues of EUR 500 million in 2021, mainly generated in the Italian market. Production amounted to around 4.5 million tonnes, which corresponds to an increase of 12.1 percent over the previous year.

A paradox situation

Commenting on the most pressing issues in the future, Giovanni Savorani, Chairman of Confindustria Ceramica, said:

“The Italian ceramic industry reported more than 15 percent growth in domestic sales and exports in 2021 compared to 2019. Healthiness, sustainability and durability are a few of the characteristics of ceramic materials that have led to them being chosen for home renovation and new construction projects. Sales continued to see double-digit growth in the various markets during the first few months of this year, but at the same time this was offset by soaring costs of production factors. The higher cost of natural gas alone will add an extra EUR 900 million to the sector’s bills, while costs of wooden pallets have already increased by 224 percent, packaging board by 180 percent, and maritime freight rates have increased fivefold. There is only limited potential to pass these increases on to prices, and this is placing enormous strain on company margins. While demand for our products is holding strong, at the same time we are paradoxically experiencing a supply side crisis of unimaginable proportions.

“The government has earmarked significant resources for households and businesses to combat high energy prices, but these will only reduce the estimated annual increase for the ceramic industry by 12 percent. However, these measures covered only the first two quarters and need to be extended until the end of the year. One of the most important structural measures is the expected release of 2.2 billion cubic metres of domestically produced gas, to be allocated at fair prices to the gas-intensive sectors most exposed to international competition, although this is a small fraction of the 20 billion cubic metres extracted annually in 1995. This must be seen as a new starting point for a more extensive use of national resources. But the most critical aspect concerns timeframes. On 1 March 2022, the Government passed the Energy Decree, which was approved by Parliament for conversion into law with appropriate amendments on 27 April. Unfortunately, more than three months have passed since then and the implementing decrees have not yet been approved, a situation that is preventing the implementation of an urgent and indispensable piece of legislation for the ceramic industry and the other manufacturing sectors involved.

“The two new floating storage and regasification units now available offer a rapid alternative to imports from Russia, although it should be remembered that liquid gas arrives by sea after journeys of thousands of miles, that the regasification process absorbs more than 30 percent of the total volumes, and that gas emissions into the atmosphere have a far greater impact than the CO2 emitted during combustion. But above all, these gas tankers are anchored on top of methane gas deposits that Italy is failing to exploit while other countries are doing so on a massive scale. This is an astonishing contradiction.

“We are in complete agreement with Prime Minister Mario Draghi in calling for a European cap on the cost of gas, a measure that is indispensable given the dysfunctional nature of the energy market. In the current very difficult economic situation, we need a strongly pragmatic approach to the process of decarbonisation, while the debates in the European Parliament are often driven by ideology. In particular, the Emission Trading system needs to be reformed to protect companies and jobs in sectors like the Italian ceramic industry which have invested the most in state-of-the-art environmental technologies and which, paradoxically, are the ones that are being hardest hit by a system increasingly subject to financial speculation.”