The German and European construction sector through to 2016

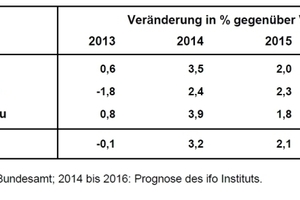

The German construction sector has been in good shape now for around three years. That is indicated in the data on the business climate emerging from the Ifo Business Survey. Among the freelance architects working only in building construction, the business climate continued to improve even into the summer. Thanks mainly to substantial planning contracts for new-build residential projects, the climate is now as good as it was back in the days of the post-reunification boom at the beginning of the 1990s. However, a slight reduction in order volumes that has been ongoing for a number of months – among building firms as well as architects – is showing quite unmistakably that this high point, too, will be coming to an end. So far, however, this cloud is so small that at least until 2015 no downturn in building investment is expected. Demand in the residential segment has been driven since 2010 by a significant influx of people. In 2012 the number of people coming to the country exceeded the number of Germans leaving by around 370,000. This year that figure is likely to rise to half a million, and for 2015 and 2016 it is unlikely to be less than 400,000 each year. This trend means that – despite an ongoing decline in the domestic population – since 2011 the total population has been increasing again. Based on the ongoing strong influx, the population will continue to rise through until 2016. The "problem" with this is that the new arrivals do not distribute themselves evenly across the towns, cities and regions, they concentrate instead primarily on regions with stronger growth, and in particular on the cities there with over 500,000 inhabitants. In their autumn forecasts the research institutes have cut their predications for GDP growth in 2014 to 1.3% and in 2015 to 1.2%. Nevertheless the employment situation and income prospects should remain favorable until 2016. Employee wages should also continue to show positive development. In this the employees have received support from a rather unusual source: the German Finance Minister and the Head of the Bundesbank. House-buyers will continue to be helped by low interest rates that should continue for some years yet. Mortgages with an interest rate fixed for ten years are already available at less than 3%. And the fear of a property price bubble in Germany is completely unfounded. On the contrary: The ever stronger price rises for housing in some cities are motivating ever more potential purchasers or home-builders to invest in their own property. Added to this is the fact that a large part of the population is concerned about the future of the euro and see very few other alternatives for investment. This year around 215,000 new-build apartments will be completed. By 2015 that figure will rise to around 250,000 units. At 3.1 completions per 1,000 inhabitants, Germany should then again exceed the average for all European countries. In commercial construction order volumes have been stagnating at a high level for around 1½ years. Among freelance architects order volumes for commercial planning projects were already indicating a peak back in summer 2012. Currently the volume of new contracts is even slightly below the long-term average. In some segments moreover we are seeing falls in production and profits because of the sanctions imposed on Russia. Many companies are also complaining about the very high (in their view) wage agreements. Thanks to the above-average qualifications of the employees, the high competitiveness should, however, be retained on the whole, so that demand for commercial construction is set to continue positively this year and next. Already in the first half of 2014, public-sector investment in construction was 8.5% higher than in the same period in 2013 – due overwhelmingly to the extremely mild weather in the winter months. Significantly higher tax revenues and the release of the first tranches in a 5-billion-euro investment program by central government will lead to a marked rise in the final figures for public-sector investment this year.

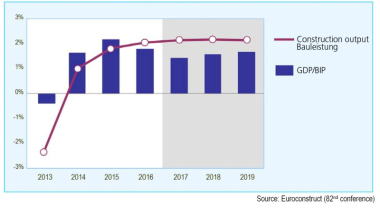

Early indications, however, point to rather sluggish demand from the public sector in the next one to two years. The only impetus in this segment is seen as coming from the improved financial situation of some local authorities, the additional funding available from central government, and the fact that many renovation and modernization measures can no longer be put off. Following a peak in European construction activity in 2007, there was a dramatic downturn in the just six years that followed. Real building volumes in 2013 were again back up at the level of 1993. 2014 will be a "turnaround" year for the European construction sector. The average growth predicted for 2014 through to 2016 is around 5½% p.a. The three most important drivers for this return to positive development are: > Population increase and movements > Increase in incomes and falling unemployment > Ongoing low interest rates

The population in Europe will rise by just under 1% through to 2016, with only Spain, Portugal and Hungary recording falls in population. Population movements play a large part here. For example, in the first 5 years of this millennium, Spain´s population grew by 3 million. Significantly above-average population growth is seen, for example, in all the Scandinavian countries and in Switzerland. In Spain and Portugal unemployment rates are the highest, while again all four Scandinavian countries are located in the bottom half of the unemployment tables. Switzerland, along with Norway, have the lowest rates. Not surprisingly, these countries in particular have a very stable growth rate in construction investment of 2-3% p.a. on average. An analysis based on building segments shows that Ireland – following a collapse of residential construction activity of 80% within the space of seven years up to 2013 – will show the highest growth rates through to 2016. Great Britain – supported by government programs – is on the way towards another speculative property bubble. In non-residential construction moderate growth is expected in all countries, at least for 2015/2016. In civil engineering future development through to 2016 is seen as being very modest, in particular in the Czech Republic and France. In Poland and the Slovak Republic, however – following significant downturns in 2012 and 2013 – there should be considerable potential for recovery.

Erich Gluch, Ifo Institute,

BAU Information Talks, October 16, 2014