By the start of Bau 2011, the recovery in the building industry will be underway

Globalisation in the building market continuesBy the time Bau opens its doors in January 2011 the European building industry should have largely overcome the consequences of the global economic crisis and a more stable situation should be emerging. However, growth rates such as were seen before the recession are not expected to return before 2012. This forecast comes in the latest report by Euroconstruct [1], a group of research institutions and consultancies from 15 Western European countries and four in Central Europe.

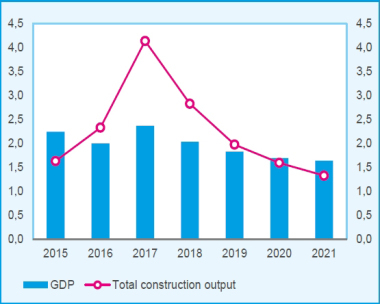

In 2009, the global economic crisis continued to impact on the building industry. Building activity had already declined in 2008, following the collapse of residential construction. In their report, the experts from Euroconstruct describe 2009 as the "worst year in over a decade". A dramatic downturn in demand in building construction, in particular in the residential segment, led to an overall decline in European building volumes [2] of 8.4 percent, to around 1.4 trillion euros. For comparison: GDP for all Euroconstruct countries fell by 'only' an average of 4 percent.

Although the downturn differed in severity between the individual countries, building activity fell in all of the countries except for Switzerland and Poland. Germany escaped relatively unscathed with a drop of 1.2%, whereas Spain (-21.5%) and Ireland (-32.2%) – where during the boom years building had outstripped demand – experienced a dramatic collapse last year.

Severe decline in new residential construction

Most of the falls were due to the in part severe downturn in new residential construction, suffered by the majority of European countries. In 2009 the market in new residential construction in Europe collapsed by an average of 22.5%. In Spain and Ireland the volume of residential construction will more or less halve in the four -year period leading to 2012 alone. In those countries many households took on more debt than they could manage when they bought property hoping for a rapid increase in value. Speculators also entered the market, lured by prospects of amazingly high yields. This further fuelled building demand, until the bubble burst and activity came to a sudden halt. Dubai is another example. While new residential construction will still be on the decline until at least 2012, Germany is one of the few countries which, according to Euroconstruct, can expect a "slight upturn" (+4%) in the coming years.

Growth in 2009 only in civil engineering

Non-residential building construction (commercial and public sectors) in 2009 fell by 9.7%, while civil engineering grew by a moderate 1.7% as a European average. The strong decline in residential construction is also shifting the balance between the three segments in the construction sector: Civil engineering will rise from 22% of total construction volumes in 2008 to 25% in 2012, with residential and non-residential building construction both losing ground.

R&M remains a mainstay in residential construction

Renovation and modernisation projects have in the past proved to be extremely crisis-resistant, and indeed this type of work has been actively encouraged in many countries through building renovation programmes. Yet even this segment did not manage to halt the recent downward trend in residential construction. R&M work fell by 3% in 2009. Nevertheless it is expected that renovation and modernisation in the housing sector will give renewed impetus to the construction industry in the coming years. But because of the already high volume of such work, growth rates will only be around 1 to 2% p.a.

Upwards trend from 2011

The good news is that the worst is now behind the European building industry – the years 2008 and 2009 were the lowest point. And, although for 2010 the 19 Euroconstruct countries can still expect a further slight downturn in business (-2.2%), from 2011 the prediction is that building activity will pick up again (+1.6%). BAU 2011, always an important test of sentiment in the industry, will be playing its part in getting things going again, with its fully booked halls and more than 210,000 visitors from all over the world. In 2012 European building volumes – with an expected rise of 2½% – are even expected to be growing faster than GDP.

The international building market

Despite the severe downturn in business as a result of the economic crisis, the 19 Euroconstruct countries, with a joint market volume of 1.4 billion euros, still represent the largest single building market. At national level, however, the leading European building nations – the 'Big Five' as they are known (Germany, Britain, Spain, Italy and France) – still considerably lag behind the world´s biggest building markets of USA (950 bn US$), Japan (725 bn. US$) and China (508 bn US$) [3]. Annual growth in double-digit figures, continuing now for over a decade in China, has rocketed this nation to third place in the league table of the world´s largest national building markets.

Globalisation continues in the building industry

The rising proportion of cross-border turnover in the global building market shows clearly that globalisation in the building industry is continuing. According to a survey conducted among leading international building firms by the American trade journal Engineering News Record, cross-border activity in 2008 rose 25% to 390 billion US$, thus doubling within the space of just four years. Internationally active building companies from China and Turkey are increasingly competing with American, Japanese and European players. The massive presence of Chinese building companies in Africa has led to international building volumes in this region rising to over 50 billion US$. On a European comparison, building firms from Turkey are now market leaders in Asia and in the Middle East. The European league table of building firms, according to size of international turnover (2008 figures), is headed by French companies (28 bn euros), followed by the German building industry (25.5. bn euros). Turkish building firms are in fifth place, with a good 12 bn euros of turnover.

Bau, too, is itself an indicator of the progress of internationalisation in the building market. The ever growing number of international visitors speaks a clear language. In 2003 around 27,000 foreign visitors from 100 countries came to Bau in Munich; in 2009 the number of visitors from abroad was over 37,000. They came from 151 countries. This trend is likely to continue at Bau 2011 from 17 to 22 January. As such, in the statistics, too, Bau will be living up to its reputation as the world´s leading trade fair for the international building industry.

Messe München GmbH

Messegelände I81823 München I Gwrmany

T +49 80) 89 94 92 06 30I F +49 (0) 89 94 92 06 89

Johannes.Manger@messe-muenchen.de I www.bau-muenchen.com

[1] Founded in 1975, the European research and consultancy network Euroconstruct is made up of institutes with specific expertise in the construction and property sector, from 15 countries in western Europe and 4 in central and eastern Europe. The Munich-based ifo Institute for Economic Research is a founder member and the German partner institute in this network. The semi-annual conferences, held at different venues across Europe, are the core activity of Euroconstruct. The last conference, the findings from which form the basis for this press release, took place in November 2009 in Zurich.

[2] According to Euroconstruct´s findings, the volume of all building services involved in constructing new buildings and maintaining and extending existing ones.

[3] The figures are based on calculations from the American consultancy 'IHS Global Insight'.