Potential consequences of a Russian gas supply freeze for brick and tile industry

A study by Prognos concludes that in the event of a supply stop of Russian gas, brick and ceramic manufacturers will potentially have to cope with some of the greatest production losses. The consequences for the economy as a whole are smaller, but remain considerable.

Uncertainty is growing about how long sufficient quantities of Russian natural gas will continue to arrive in Germany. It is equally uncertain what a further reduction or even a loss of gas supply could mean for the German economy. The only thing that is clear is that in that case there will be consequences for economic performance. After all, most of the manufacturing sector is not among the so-called “protected customers”. In the event of a shortage, these are supplied with gas on a subordinate basis.

Originally, this question was discussed in connection with a gas boycott. In the meantime, the shape of the problem has changed - it is no longer about the consequences of a German embargo on Russian gas deliveries, but a possible delivery boycott from the Russian side. Delivery volumes have already been restricted. In mid-March, Ukraine partially stopped gas transit, and in mid-June, GazProm cut the daily delivery volume by about a third. From 11 July, the Nord Stream 1 pipeline will undergo an annual ten-day routine maintenance. The German government’s concern is that gas deliveries will not be resumed afterwards.

A study prepared by Prognos and published at the end of June shows the potential consequences that an abrupt delivery failure could have for the German economy as a whole and for the brick and tile industry in particular. In addition to the direct effects on gas consumers, the analysis also includes the indirect effects in upstream and downstream industries. To this end, the study focuses on relevant production processes in German industry and possible declines in production. The starting point is a scenario in which gas deliveries from Russia cease from 1 July 2022. The analysis examines the consequences in the period under consideration, the second half of 2022.

Brick and ceramic manufacturers most dependent on natural gas

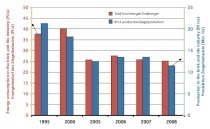

According to the Prognos study, the mineral processing industries show the greatest dependence on natural gas. In the brick and tile industry, the share of natural gas in final energy consumption is 82 percent. Only the ceramics industry has a higher share at 86 percent. No other industry is so dependent on natural gas. The authors of the study speak of a “massive dependence”.

It is striking that the high dependence is not accompanied by high consumption relative to the total quantity. The brick and tile industry uses only two percent of the total amount of gas, the ceramics industry even only one percent. Other sectors of the economy consume significantly more proportionally, such as the basic chemicals industry (35 percent), the food industry (10 percent) and the paper and steel industries (8 and 7 percent respectively).

Production down by 32.5 per cent in the ceramics, processed stone and earths sector

In the event of a supply disruption according to the scenario, Prognos expects as a result of the calculations that production in the ceramics, processed stones and earths sector, which includes the brick industry, could fall by 32.5 percent. This would be the third-highest shortfall in percentage terms. Only the pig iron and steel sector (minus 34 percent) and the glass industry (minus 47.8 percent) would have to reckon with larger production losses.

Potential value-added losses: minus 34 percent

The effects on value added associated with the decline in production are large for the economy as a whole, and in some sectors they are even massive. Gross value added in Germany could fall by around 12.6 percent. Direct losses account for 3.2 percent, upstream losses for 3.0 percent and downstream losses for 6.4 percent of value added.

The effects on the value added of individual sectors are in some cases considerably greater. For the ceramics, processed stones and earths sector, the study arrives at potential value-added effects of minus 34 percent. Only the pig iron/steel (minus 50 percent), glass (minus 48 percent), chemicals (minus 37 percent) and printing (minus 35 percent) sectors are more severely affected. Construction is one of the sectors only indirectly affected. However, Prognos expects a decline in value added of almost 11 percent due to intermediate inputs.

The impact of the decline in production and value added in the ceramics sector on the economy as a whole is rather small. The effect is a little more than 0.1 percent minus. In contrast, the study assumes that the losses in the construction industry could reduce Germany’s total value added by 0.5 percent.

The study “Consequences of a supply disruption of Russian gas for German industry” was prepared by Prognos AG on behalf of the vbw - Vereinigung der Bayerischen Wirtschaft e. V. (Bavarian Business Association). The German text is available on the VBW website.