The road to climate neutrality calls for dependability

With its roadmap, the German brick and tile industry has charted the course for climate-neutral processes and products. The process of transformation is formidable, demanding a great deal from the manufacturers. Key precondition for the success of this feat are dependable framework conditions that promote innovations, safeguard competitiveness and not least strengthen cooperation between politics and business.

In 2020, the German clay brick and tile industry emitted around 1.7 million tonnes CO2. Despite these making up a comparatively low percentage of the total emissions in Germany (0.2 percent), our industry is one of the energy-intensive industries, and it is very aware of its social responsibility to reduce CO2. In the last 30 years, we have already been able to make an active contribution to achieving the climate goals. With more efficient processes, the full switch from coal to natural gas as well as innovative technologies, the German brick and tile industry has almost halved its annual energy consumption from 10 TWh in 1990 to 5.4 TWh today and reduced emissions by around 40 percent. We have therefore already made it to the halfway mark, but the more arduous stretch of the road still lies ahead of us. The detailed roadmap we have published charts the way to climate neutrality by 2050. A brief time later, the climate goals were tightened up by the Federal German government. Instead of by 2050, climate neutrality is now to be achieved by 2045.

Climate neutrality as a cost-intensive tour de force

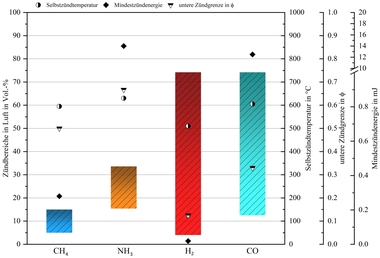

By doubling its annual investments in climate protection, the brick and tile industry could lower its CO2 emissions by 60 percent under its own steam by 2030 – that is more than the 55 percent required by the EU. But the last mile on the road to decarbonization demands the greatest efforts. 60 percent of the CO2 emissions are formed as a result of the combustion of natural gas in combined dryer-kiln heating configurations. This is the key approach to the reduction of fuel-related emissions. If we decouple dryers and kilns, the kilns can – given sufficient lead time – be switched to green hydrogen or electricity generated from renewable resources.

But it is still unclear from when and where the fuels of the future will be available. This uncertainty makes investment decisions difficult, ultimately delaying them. With the switch from natural gas to electricity, it would be necessary to invest in completely new plant engineering. The costs for a new tunnel kiln that runs around 40 years range between 10 to 15 million euros. For hydrogen, we could convert our installations with much lower investments. Completely unclear so far is how climate-neutral fuels will affect the product properties of clay bricks and tiles. In this respect, more research is necessary.

Other saving effects can be achieved with the use of high-temperature heat pumps at the dryers, the complete electrification of the other parts of the production process as well as the successive increase of the percentage of recycling in production. Biggest challenge for our industry is the reduction of the process-related emissions, which make up around 30 percent. They are formed as a result of the content of lime in the clay raw material as well as the added porosification agents. Bricks are regional products, that is the brick plants are located there where the clay pits are found. If a switch were made to zero-lime clay, the clay would have to be transported to the plants from other regions, which would incur additional costs and emissions.

For the brick and tile industry, the zero-CO2 scenario means total investments in excess of 2.3 billion euros. A sum of money that our sector with its predominance of medium-sized enterprises cannot finance. If the transformation costs of our industry are compared with the companies’ financial scope, then a discrepancy between the climate policy demands and business reality is clearly revealed. This conflict of objectives must be resolved by policymakers and business working together.

Safeguarding energy supply and competitiveness

Even if we implement all the measures in our roadmap already by 2045, we can only directly influence the transformation to a certain extent. A key contribution has to be made by the policymakers. Our energy mix in the target year 2050, going by projections, will be based on 1.0 TWh green hydrogen, 1.4 TWh green electricity as well as another 0.2 TWh biogenic solid fuels. Whereas Germany is still very much at the beginning when it comes to the supply of hydrogen, having neither sufficient production capacities nor the necessary energy infrastructure, 251,0 TWh regenerative electricity was generated in 2020. Nevertheless, massive development is necessary, just to to get anywhere to covering the requirements of the entire industrial production.

On top of that, our companies are carrying a double burden in the transformation – with rising CO2 costs and necessary investments in zero-emission technologies. This additional financial burden is a risk with regard to maintaining competitiveness and can only be mitigated with external support. One good option are, for instance, carbon contracts for difference, which balance the difference between the CO2 price and the CO2 avoidance costs.

Brick and tile industry on track for recycling economy

The recycling economy is another challenge that our sector must meet over the next few years. The starting situation is favourable as bricks and roofing tiles are some of the building materials that can be recycled. Crushed bricks are already being recycled today – as surfacing and filling material in road construction, aggregate for concrete, surfacing for sports grounds or as plant substrate. With cost-intensive research projects, we are coming ever closer to the declared goal of prospectively using brick as a material resource for the construction of new buildings.

Unmixed brick rubble can be returned to the production process without any difficulties and substitute up to 30 percent of the necessary raw materials. Much more complex is the recycling of mixed brick waste from building demolition. Going by new developments in separation and sorting equipment, we can predict that this hurdle will soon be overcome. Together with demolition and recycling companies, we are working to build up a nationwide recycling infrastructure.

Another starting point for conserving valuable resources is the reuse of material excavated from construction sites as a raw material for brick production. At present, excavated material is currently landfilled at prohibitive cost, also because of excessive bureaucracy – this stands in the way of the desired recycling economy. Here upcycling would be easily possible following suitable quality control. Precondition is that the material is available regionally in sufficient quantities and its ceramic-related suitability for brick manufacture has been proven.

Crucial for a functioning recycling economy in the brick and tile industry are corresponding technical, environmental policy and not least economic framework conditions. For example, there are still obstacles to the use of recycled building materials, which the new German government must at last clear out of the way. That starts with recycled building materials, which, in some cases from an administrative perspective, must still meet the same requirements as waste. Recycled mineral-based substitute building materials derived from bricks, which are subject to strict quality control should be removed from the waste regime and be available with recognized product status as a recycled building material for reuse. It will only be possible to realize concepts such as cradle2cradle and urban mining in the mid-term if there is corresponding regulatory flexibility. In view of the ambitious climate goals, Germany can no longer afford years of talks, like those surrounding the Mantelverordnung (umbrella ordinance on substitute building materials).

Regional products safeguard affordable housing

According to our calculations, brick products will increase in price by around 40 percent because of their climate-neutral production. That may sound a lot on initial consideration, but will be put into perspective in the longer term. The current price increase for individual construction materials can be attributed primarily to the dependence of the German building industry on global value creation chains. It is therefore worth making a greater commitment to local mineral-based construction products. Raw materials such as clay are available in sufficient quantities, even if approval processes for the extraction of new raw materials have becoming increasingly protracted. The German brick and tile industry is capable of ramping up production very quickly and can thus respond to a higher demand. In view of the persisting housing and rental crisis, it can’t be that urgently needed housing cannot be completed because of a shortage of construction materials.

The statement “Housing is the social issue of our time” has now become ubiquitous in debates on construction policy. In view of price increases for construction materials such as wood, steel or insulation material, the fear is that the already high rents will rise further. Affordable housing always begins with the cost efficiency of the construction method. Here solid brick building offers considerable advantages: According to a study by the Arbeitsgemeinschaft für zeitgemäßes Bauen (ARGE – Workgroup for Contemporary Construction), the costs per square metre exterior wall in apartment building construction with brick masonry are around 10 to 20 percent below that for other wall-building materials. The price benefit of brick masonry results from its fast and easy installation as well as the long lifetime of 100 years and more.

With CO2-neutral processes and products alone, the climate goals in the building sector probably can’t be achieved. As the usage phase is the driver of CO2 emissions, we must in future build in a more climate-friendly way. Extreme summers with daytime temperatures up to 40 degrees show that climate change has long arrived in Germany. Nevertheless, winter thermal insulation is still the benchmark. In the evaluation of the energy efficiency of a building, the focus is still on heating energy consumption. To keep this as low as possible, the exterior walls are fitted with additional thermal insulation. With the consequence that more and more energy., cost- and maintenance-intensive ventilation and cooling technology must be used to regulate room temperatures. Worldwide, already a tenth of consumed electricity goes into air conditioning systems and fans. According to the forecasts of the international energy agency, this will triple by 2050. Wouldn’t it be more sensible to tackle the causes of overheating instead of alleviating symptoms? Many architects and building designers are calling for a rethink: a move away from insulation, and towards more heat storage. Here the material properties of construction materials play a crucial role. Smart climate architecture is based on robust construction and not complex technology. Thanks to their thermal storage mass, bricks are able to buffer heat in summer while retaining heat longer in the building in winter. In this way, solid brick masonry can balance out temperature peaks in a natural way.

Clay roofing tiles and masonry bricks are favoured building materials in housing construction. And that for good reason – bricks combine sustainability with high cost efficiency. To meet the future social challenges, politics and business have to work hand in hand, that applies for changing the energy infrastructure, for an effective recycling economy, for safeguarding the supply of raw materials and everything in combination with maintaining our prosperity. Policymakers have raised climate goals, industry has presented roadmaps to realize these. Now it is time to work together on realistic solutions. The clay brick and tile industry stands ready as a dependable partner to make an active contribution to building affordable and sustainable housing.