2009: Decline on a high level

VDMA: Manufacturers of Construction Equipment and Building Material Machinery well prepared for the end of the boom

Following six growth years in succession, the German construction equipment and building material machinery industry expects to see an end to the construction boom in 2009.

Significant sales increases for building material machinery At present, the industry is still enjoying growth. During the first nine months of 2008, sales of the German construction equipment and building material machinery industry overall increased again compared to the same period last year. This was due particularly to the development in the building material machinery industry. Sales of building material, glass and ceramics machinery grew by 79% during this period. This strong increase is the result of major orders in the cement machinery sector. With a total of 7%, the growth in construction equipment machinery was significantly lower. Domestic sales grew by 2%, whereas export sales rose by 9% in this sector. The Association is expecting a sales increase of 8.6% to t 16.6 bill.

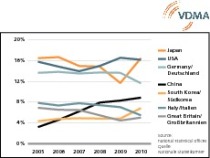

Export flourishing – competition from China increasing Export is crucial for the industry. During the first nine months of this year, construction equipment and building material machinery worth nearly t 8 bill. was sold abroad. This is about 16% more than in the prior-year period. With a 68-% export quota, Europe is the biggest sales market, followed by Asia (9%) and North America (7%). Germany holds 14% of the world export quota. “We have taken a proportional share in growth, while countries such as the USA, Japan and Great Britain have lost market shares to other competitors – to the Chinese in particular”, Mr Kemmann remarked. Chinese companies have expanded their global export activities significantly during the past five years and, with this, their global market share grew from 2 to 6% during this period of time. Chinese companies export particularly to Africa, Latin America and the Near East and Middle East, and are currently trying to gain a foothold in Russia. According to Mr Kemmann, though, they had not yet been successful in gaining any notable market shares in Europe and North America.

Forecast for 2009: decline – albeit on a very high level

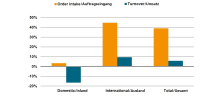

The general economic situation is showing obvious signs of weakness. The Federation’s Association of the Construction Equipment and Building Machinery Industry therefore expects a decline in turnover for the industry overall in 2009 of 4.6% to about t 15.8 bill. t 10.7 bill. (loss of 7.5%) of this for construction equipment and t 5.1 bill. (increase of 2.2 %) for building material machinery.

Domestic sales will decline by 13.8 % to t 3.3 bill. and export sales will also decline by 1.8 % to t 12.5 bill.

According to Association experts, a positive change in the economic situation for the construction equipment and building material machinery industry can only be expected in the second half of 2010 at the earliest.

Dampening effect – a lack of engineers

Recruiting qualified staff is difficult for the construction equipment and building material machinery industry with its dominance of medium-scale companies. Almost all companies are looking for engineers. Dr. Kemmann reported that the Association had launched a “Young Staff Initiative”, which was embedded into other activities organized by the German Engineering Federation. The aim of this initiation is to show young people the various career opportunities this specific industry has to offer as well as to promote the industry as an attractive employer.

Product piracy threatens competitiveness

According to a survey conducted by the German Engineering Federation in April 2008, the entire industry has suffered a loss in sales of Euro 7 bill. per year as a consequence of product piracy. According to the survey, companies need to implement extensive strategies to fight product piracy, including legal protection, organizational and technical as well as specific public communication measures. In this context, the German Engineering Federation is increasing the pressure on the German government and the European Union to adopt a more determined stance against product piracy. The China IPR SME Helpdesk, which the German Engineering Federation had long called for, is a big achievement and success. It was set up in May 2008 as a point of contact for all companies affected by plagiarism in the region.

VDMA

Fachverband Bau- und Baustoffmaschinen Lyoner Straße 18 I 60528 Frankfurt/Main I Germany

T +49 (0) 69 66 03 12 57 I F +49 (0) 69 66 03 22 57

www.vdma.org