Residential construction in Germany: slowdown in the downward trend

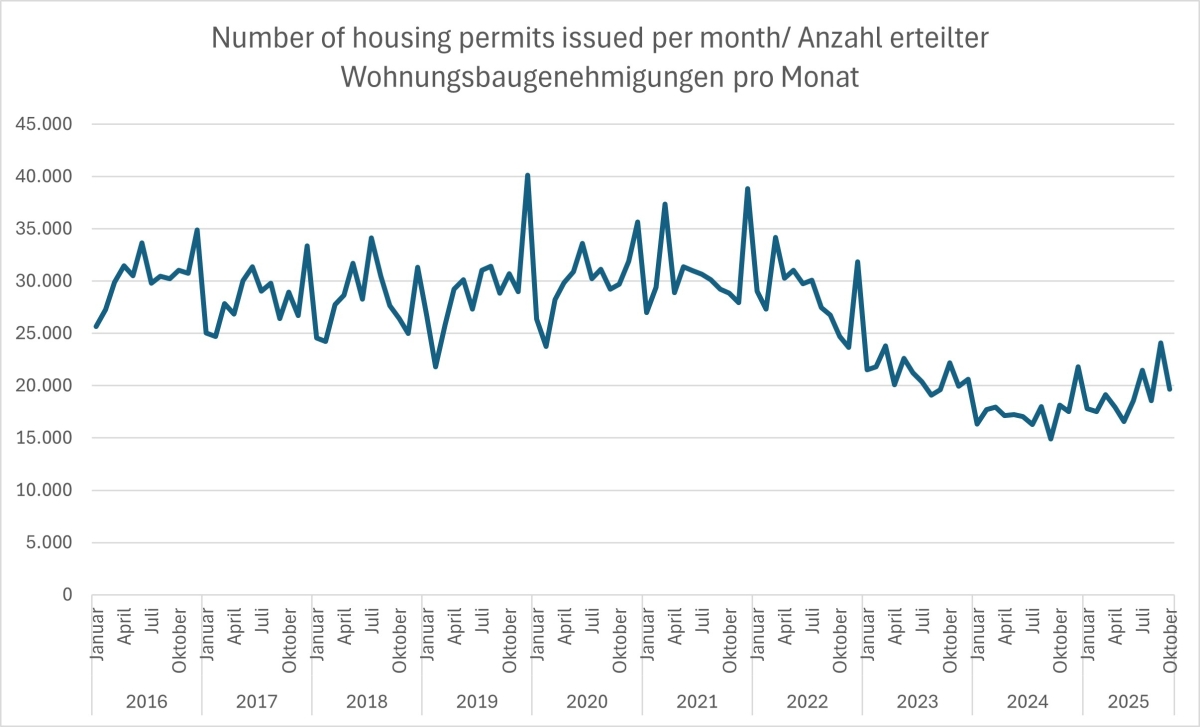

16.07.2024The trend of falling building permit figures appears to be slowing down. According to a report from the Federal Statistical Office in June, the number of residential building permits has fallen again. In April 2024, the construction of 13,500 homes was approved in Germany, around 3,600 or 17.0 per cent fewer than in the same month last year. The approval figures in March 2024 were still 24.6 per cent down on the same month last year.

This weakening trend is also evident in a two-year comparison. In a comparison between April 2024 and April 2022, the number of building permits even fell by 43.5 per cent or 13,500 flats, as the Federal Office points out. In contrast, the figures in March 2024 were 46.9 per cent below the level of March 2022.

Slightly smaller decline in the number of single-family homes approved

A slight easing can also be seen in the individual segments. Compared to the same quarter of the previous year, the number of building permits for single-family homes fell by 32.5 per cent or 5,900 to 12,300. In contrast, the decline in permits issued in the period January - March 2024 was still 35.6 per cent compared to the same quarter of the previous year.

The number of two-family homes approved in the first quarter of 2024 fell by 18.3 per cent or 100 to 4,400 compared to the previous year. From January to March 2024, a year-on-year decline of 20.0 per cent was recorded. For the largest building type in terms of numbers, apartment blocks, the number of approved flats fell by 20.9 per cent or 9,700 to 38,500 flats. One month earlier, the decline was 22.9 per cent.

Slight decline in lack of orders in residential construction

The ifo Institute's report from 15 July 2024 paints a similarly clear picture, with 50.2% of the companies surveyed reporting a lack of orders in June. In May, the proportion was still 51.7 per cent, in April 55.2 per cent.

"The lack of new orders continues to be a major problem. House builders are cautious, partly because the European Central Bank's interest rate cut is only a first step for the time being. Not much has changed in terms of financing costs. This is also reflected in the development of building permits," says Klaus Wohlrabe, Head of ifo Surveys.

The cancellation rate for orders has also fallen slightly to 13.7 per cent in June 2024, compared to 15.1 per cent in May. In April, 17.6 per cent of companies reported cancelled projects, compared to 19.6 per cent in March. Although the business climate in residential construction improved slightly, it is still clearly in negative territory at -44.3 points. "The sector is still a long way from optimism," adds Wohlrabe.