Statistical figures on brick production in Germany in 2024

The German brick and tile industry experienced another challenging year in 2024. This follows the general situation in the construction industry, which is also at a long-term low. The decline in building permits since 2022 was repeated in 2024. At 215,900 new homes, 16.8 percent fewer were approved compared to the previous year. The last time fewer residential construction projects were approved was in 2010. This slump is particularly affecting the brick industry, as heavy clay building materials are primarily used in residential construction. The effect can be seen in the statistical figures published in the German brick and tile makers association 2024 annual report.

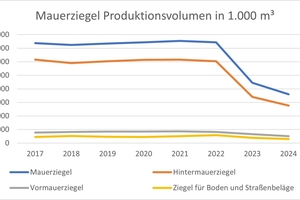

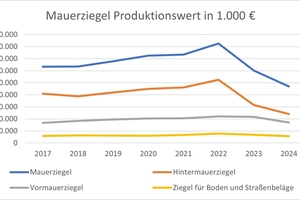

Statistical figures on the production of masonry bricks in 2024

The production volume of masonry bricks fell by around 19 percent to 3,605,000 m³ in 2024 compared to the previous year, significantly less than the drop of almost 40 percent from 2022 to 2023. Comparing 2024 and 2022 figures, the decline is around 51.5 percent. The production value fell by around 22 percent compared to the previous year to around 469 million euros. The decline is therefore slightly lower than the previous year’s rate of minus 27 percent. In a two-year comparison between 2024 and 2022, the production value fell by around 43 percent.

In a comparison of absolute figures, the production volume in 2024 represents the lowest point in more than 20 years. The production value in 2024 is only lower than the values in 2008 and 2010.

In a comparison of the product groups, clay blocks are particularly affected. Over two years, the production volume fell by around 54 percent, as did the production value. The decline in facing bricks over the same period amounted to 38 percent and around 23 percent respectively. The largest decline in the production volume and value of clay blocks in relation to the previous year occurred in 2023 (2023: minus 43 percent and minus 39 percent respectively/ 2024: minus 18 percent and minus 23 percent respectively). While the decline in clay blocks therefore slowed slightly, the opposite is true for facing bricks. Here, the declines accelerated in 2024 compared to 2023 (2023: minus 20 percent and minus 2 percent respectively/ 2024: minus 22 percent and minus 21 percent respectively). This applies in particular to the production value, which remained almost at the previous year’s level in 2023 and fell significantly last year.

In contrast, the volume and value of production of bricks for floors and road surfaces developed in different directions. The production volume fell by around 33 percent from 2022 to 2023 and by only around 19 percent from 2023 to 2024. The production value, on the other hand, fell by 12 percent in the first interval. The rate accelerated to around 17 percent in the second interval.

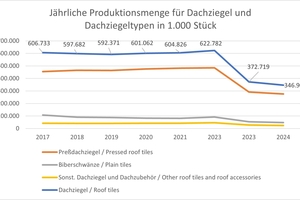

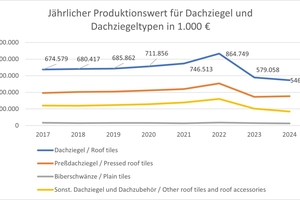

Statistical figures on the production of roof tiles in 2024

The situation for roof tiles is calmer, but not better. The production volume 2024 compared to 2023 fell by around 7 percent to 346,903 thousand units. This means that the decline has slowed considerably compared to the same period in the previous year (2022 to 2023), when the rate was around 40 percent lower. Overall, the production volume has fallen by around 44 percent since 2022.

The production value in 2024 was around 5.5 percent below the previous year’s level at around 547 million euros. In the previous year, the decline was still 33 percent. Overall, the production value in 2024 was around 37 percent lower than in 2022.

Compared to the other product groups, pressed roof tiles have been relatively least affected by the construction crisis. Nevertheless, the declines are considerable. Over two years, the production volume fell by around 43 percent and the production value by around 30 percent. In the same period, the production volume of plain tiles fell by around 48 percent and the production value by around 30 percent. Both product groups experienced the biggest drop between 2022 and 2023, with the volume of pressed roof tiles produced falling by around 40 percent and their value by around 32 percent. In contrast, the volume fell by only 5.5 percent between 2023 and 2024, while the value even increased by around 2 percent. The volume of plain tiles produced in 2023 was around 42 percent below the previous year’s level, while the value was around 20 percent lower. In 2024, 11.5 percent fewer plain tiles were produced at a price around 13 percent lower than in the previous year.

Other roof tiles and roof accessories experienced the same trend to a particularly pronounced extent. Overall, production volume and value fell by around 49 and 48 percent respectively. From 2022 to 2023, the volume and value of other roof tiles and roofing accessories fell by around 41 and 36.5 percent respectively. In a comparison of the years 2024 and 2023, the decline in production volume was only 13 percent and in production value around 17 percent.