Turnaround for Italy‘s ceramic technology sector

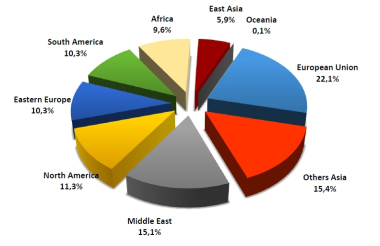

Export markets

China, Taiwan and Hong Kong were the top export area, with 203.7 million euros (up 63% over 2009) and a 19.1% share of total export turnover. The European Union dropped to second place, with 188.6 million euros (-25.1%) and 17.7% of total exports. The Middle East retained an essentially stable third place, with turnover totalling 152 million euros, followed by the “rest of Asia” category, i.e., India, Thailand, Indonesia and Vietnam, with a turnover of 145.4 million euros (13.6% of the total and 37.1% higher than in 2009). South America came in fifth, with 129.5 million euros, followed by Africa (119 million euros), Eastern Europe (84.5 million euros), North America (42.7 million euros) and Oceania (0.9 million euros).

Italy

The sector‘s structure

The breakdown of companies by size also remained extensively the same as before: 56% reported turnovers below 2.5 million euros, and only 10.6% had sales exceeding 10 million euros.

In 2010, a total of 57 companies majority-owned by Italian groups were operating outside of Italy. These companies generated turnover adding up to 338.2 million euros, or 28.7% better than in 2009.

Forecast for 2011

The Italian machinery manufacturers are also eagerly awaiting a recovery for the Italian domestic market. “During the first few months of this year, our companies secured major supply contracts with leading Italian firms”, says Cassani, “and we hope that this trend will continue on for at least the next six months.”

Client sectors

Thanks to strong sales in Italy (+34.7%), the refractories industry suffered much less than in 2009, i.e., this segment‘s total sales volume for 2010 came to 31.9 million euros (-12.4%).

Turnover according to machine category

Shaping machines were down 16% last year, while clay preparation machinery (-6.4%), engineering (-13%) and laboratory instruments (-8.7%) all fared somewhat better.

Conversely, substantial growth was achieved in the sale of machines for glazing and decoration (+20.1%), due largely to investments in digital technology. Strong performance was also shown by machinery for drying (+1.9%), firing (+8.6%), sorting, packaging and palletization (+28.1%), machinery for finishing (+19.5%), mould-making (+9.2%), purification systems (+16.4%) and quality and process control equipment.