Sales record in 2016 for the Italian ceramic machinery suppliers

These results were driven by excellent performances both on the domestic market (+4.5 %), bringing turnover in Italy to € 481.3 mill., and on international markets (+1.6 %), which in 2016 generated revenues of € 1.546.4 bill., 76.3 % of the total.

2016 marked the fourth consecutive growth year for the Italian market. Investments made by the important Italian clientele generated turnover growth of more than € 100 mill. (up 44 % on 2013). Employment saw an equally positive trend, rising by 6.2 % (compared to +0.4 % the previous year) to a total of 6 614 people. At the same time, the number of companies operating in the sector remained more or less stable at 147 compared to 148 in 2015.

Exports

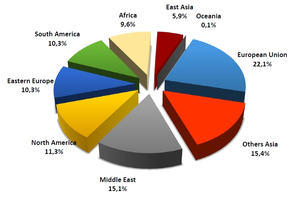

The Italian ceramic machinery industry continues to be highly export-oriented and has maintained its world-leading role in the sector. The export shares are divided equally amongst the main regions.

The largest area of export in 2016 was the European Union with a turnover of € 342 mill. (22.1 % of total turnover, 23.3 % up on 2015). Southeast Asia dropped to second place with 15.4 % of total turnover, down from € 277.9 mill. to € 238.2 mill. (-14.3 %). In third place, the Middle East saw 25.1 % growth (€ 233.5 mill., 15.1 % of global exports). North America climbed to fourth place in 2016 with 8.5 % growth to € 174.5 mill. In fifth place was Eastern Europe with € 158.9 mill. (+3.9 %), 10.3 % of total exports. South America fell to sixth place following a 14.6 % contraction to € 158.7 mill. Next came Africa with a total of € 148.6 mill. (-27.1 %), China, Hong Kong and Taiwan with € 90.8 mill. (+20.4 %) and Oceania with a turnover of € 1.2 mill.

Along with exports, a total turnover of almost € 500 mill. was generated by the 67 companies operating outside Italy but controlled by Italian firms.

Brick and tile industry

Sales of machines and equipment to brick and roof tile manufacturers fell from € 156.1 to 152.8 mill. (-2.1 %), although it remained the second largest client sector.

Forecasts for 2017

The initial forecasts for the current year are positive. The figures for the first quarter of the year published by the Acimac Research Department reveal 13.3 % growth driven by the record performance in the Italian market (+60.6 %). “Many of our companies have an almost completely full order book for 2017 and are beginning to plan deliveries for early 2018”, commented Paolo Sassi, President of Acimac. “We therefore expect to see slight end-of-year growth with respect to the already excellent results of 2016.”

Acimac

www.acimac.it