Brick production in Belgium down by around a quarter in 2024

The year 2024 was marked by significant challenges for the Belgian construction sector. According to Embuild, the Belgian Construction Association, residential construction suffered a 7.3 percent drop in activity last year. The residential new construction sector was hit hard. The residential renovation sector experienced a slight growth of 0.5 per- cent.

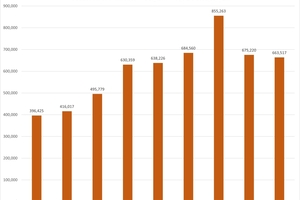

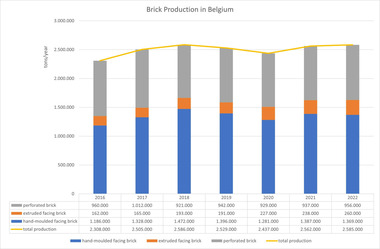

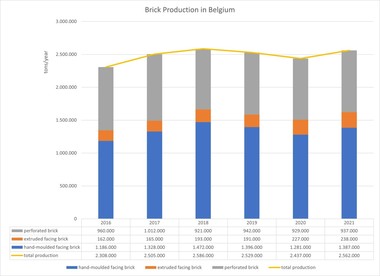

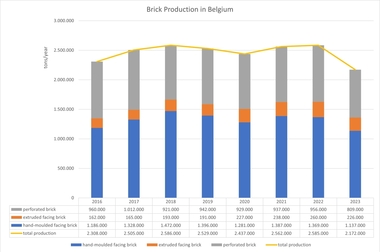

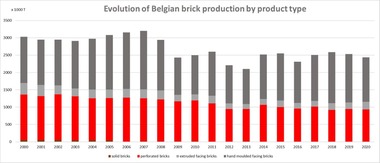

The brick industry felt the impact of these developments. Total brick production in Belgium was around 1,611,000 tonnes, down 26 percent from 2023. 630,000 tonnes of bricks for ordinary masonry and 981,000 tonnes of facing bricks were produced. In 2024, production of brick slips amounted to 663,517 m². Production of narrower eco-format facing brick evolved to 1,013,719 m². Exports amounted to 671,213 tonnes, about 42 percent of total production. The export figures are compiled on the basis of a member survey and National Bank of Belgium (NBB) data.

Exports were mainly to neighbouring countries. The UK remains the main export country for facing brick in 2024. The Netherlands is the main export country for internal wall bricks. Imports experienced a decrease compared to last year, 134,667 tonnes of brick products were imported into Belgium (source NBB). The Netherlands was the main country of origin.

The number of building permits issued in Belgium in 2024 for both renovation and new construction was lower than in 2023. The number of building permits for new housing (single-family houses and flats) last year was at its lowest level since 2002. According to figures by Statbel, the belgian statistical office, 44,015 permits were issued for new construction of single-family houses and flats in 2024, down 13 percent from 2023. The number of licensed renovations of residential buildings in Belgium decreased by 4 percent to 26,427 units.

The outlook for construction in 2025 is uncertain. As the number of building permits granted is a good indicator of construction activity, 2025 therefore does not promise to bring much immediate improvement. For 2025, the construction and installation sector as a whole expects another 0.3 percent decline, according to Embuild.

However, the structural needs of the Belgian housing market remain as great as ever. To avert a housing crisis, more than 400,000 affordable homes must be built between now and 2030 because of demographic trends, such as more single-parent families, singles and seniors. The pace of renovation must also be firmly stepped up to meet European climate targets.

In 2025, the Belgian Brick Federation will continue to focus its activities on the issues that are extremely important to the industry and remain committed to a sustainable, innovative and forward-looking sector, allowing brick products to continue to play an essential role in construction.