French brick market in 2021: Corona-related losses more than offset

The French brick and tile sector recovered well in 2021 from the impact of the Corona pandemic on production and the market. However, the first problems in the gas and electricity markets were already emerging. This is reported by the French industry association Fédération Française Tuiles & Briques (FFTB) in its annual report 2021.

Market for bricks has recovered

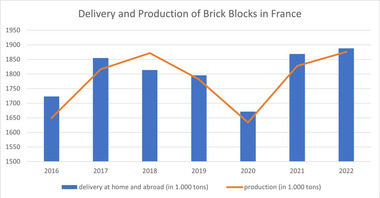

The Corona pandemic had led to the closure of almost all production lines in France. The quantity of roof tiles produced fell by 6.5 percent, the quantity of hollow bricks produced by as much as 8.3 percent. This decline in production is only partially reflected in the domestic and foreign delivery figures that characterise sales. Thus, in the same year, the quantity of roof tiles delivered increased by around 1 percent, while the quantity of hollow bricks delivered fell by only 7 percent. According to FFTB, demand from dealers and the construction industry was partly met from stocks.

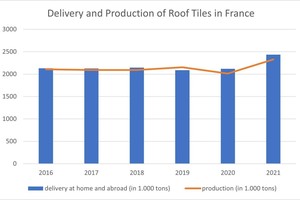

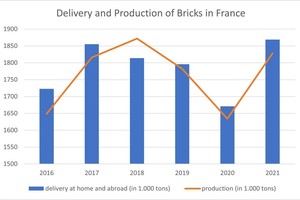

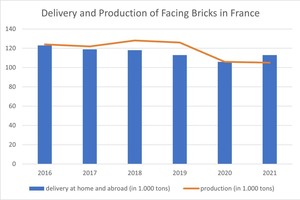

In 2021, production and delivery figures picked up again very significantly and reached record levels in terms of both percentage development and absolute figures. According to FFTB, a comparable delivery level was last observed in 2013. The production of roof tiles increased by 15.8 percent, from 2012 kilotonnes to 2,330 kilotonnes. Domestic and foreign deliveries increased by 15.0 percent to 2,437 kilotonnes. In the case of hollow bricks, both production and delivery volumes were 11.9 percent above the previous year‘s level. A total of 1,828 kilotonnes were produced and 1,869 kilotonnes delivered. In 2021, facing bricks again reached the level of 2019 in terms of delivery volume, while production volume actually fell by 1 percent compared to the previous year.

This development was driven by the very dynamic markets for new construction and renovations with their high demand for clay building materials. This is helped by the fact that, according to FFTB, around 70 percent of roofs in France are covered with roof tiles. Backing bricks are in high demand in residential construction, with one in three dwellings using backing bricks.

Rise in energy prices in the second half of the year

But apart from the effects of the pandemic, which were still being felt in 2021, another development began to affect the business activities and profit expectations of the companies in the sector last year: the rise in the cost of electrical energy and gas in particular.

A megawatt hour (MWh) of gas cost an average of EUR 97 in the fourth quarter of 2021, compared to EUR 18.40 in the first quarter. The record value in 2021 was reached on 21 December at EUR 180 per MWh of gas. For electricity, prices rose from EUR 50 to EUR 156/MWh. This development is likely to continue this year.