1 Small installation opt-out rule

From 2013 installations that emit less than 25 000 tonnes CO2 per year can be exempted from the emission trading scheme by the member states after consultation with the affected installations and providing the following conditions are met:

› �equivalent measures are implemented so that equivalent reductions are achieved

› �the installations are monitored to ensure that no more than 25 000 t CO2/year are emitted

› �if more than 25 000 t CO2/year are emitted, the installation is re-included in the EU ETS and

› �all information on the specified conditions are published

Currently, more than 80 % of the ceramics installations participating in emission trading in Germany fall under this small installation rule.

According to information from Germany’s Federal Ministry of the Environment (BMU), Germany intends to implement the small installation rule. According to the BMU, the details of the equivalent measures (energy management systems?) will be discussed with the affected groups, that is the ceramics industry too, from the beginning of 2011. The Federal Association of the German Brick and Tile Industry Regd. will initiate and present the industry’s standpoint in good time.

2 For all installations still participating in the EU ETS:

the cap

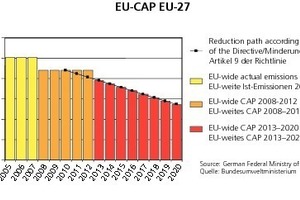

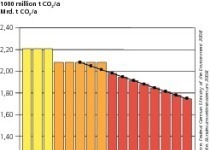

All installations that emit more than 25 000 tonnes CO2 per year, and also those that do not want to participate in the small installation rule, will remain in the emission trading scheme. The EU-wide cap from 2013 to 2020 will entail the following measures (»1).

From 2010, 1.74 % will be deducted each year from the annually allocated amount in 2010. The Cap in 2020 corresponds to an emission reduction of minus 21% in 2005.

2.1 Free allocation

Free allocation will be arranged uniformly Europe-wide on the basis of benchmarks. Allocation will be calculated per installation with the help of the following formula:

Allocation = BM x Production x CL x LR x WR (1)

BM = Benchmark

Production = average production in a base period

(2005 – 2008 is under discussion)

CL = carbon leakage factor

(0.8 in 2013 to be reduced in stages to 0.3 in 2020 or 1)

LR = linear reduction factor

(its application is currently under discussion)

WR = other reduction factor (if allocation > Cap)

2.2 Benchmarks

The Europe-wide uniform benchmarks are drawn up in commitology proceedings, i.e. the Commission makes a proposal, which the Parliament and Council then consult on and generally approve. Contact partner for the Commission is Tiles and Bricks of Europe – the European Tile and Brickmaking Association; the Federal Association of the German Brick and Tile Industry Regd will be actively involved in the relevant committees. The benchmarks should represent the average of the Europe-wide best 10 % for each product in 2007 and 2008. As the database for this is not available, the Commission has arranged for a consortium of consultants to conduct a study for every industry. The study for ceramics was conducted by Ecofys (see: http://ec.europa.eu/environment/climat/emission/pdf/bm/BM%20study%20-%20Ceramics.pdf)

In this study five benchmarks are proposed for the clay brick and tile industry: heavy clay backing bricks, lightweight clay blocks, facing bricks, paving bricks and roof tiles. On the basis of the available data, only three benchmarks have been defined so far:

› �114 g/kg brick for backing bricks

› �133 g/kg brick for facing bricks

› �151 g/kg brick for roof tiles

The lobbying of the TBE European Clay Brick and Tile Association is now concentrating on improving the database. The TBE considers two benchmarks for backing bricks as inappropriate because very different backing bricks are produced across Europe and the process-related emissions vary widely in this product group. For this reason, in the view of the TBE, as a fall-back option, an energy efficiency benchmark (basis natural gas) should be applied. By 31.12.2010, the details of the benchmarks (how many, what level) should be defined.

2.3 Carbon leakage

At present, the clay brick and tile industry is not yet listed as being exposed to a significant risk of carbon leakage. The reason is that the required trade intensity with non-EU countries could not be established. Under pressure from the clay brick and tile industry, the clay brick and tile industry has now been explicitly mentioned in recital 16 of the Commission Decision on carbon leakage dated 24.12.2009 and the need for reassessment as soon as possible noted. The European Clay Brick and Tile Association TBE has now contracted the firm of consultants PriceWaterhouseCoopers to conduct a qualitative study. In this study, the consultants are to show how massive market distortions will result without carbon leakage listing. In addition, the study will explore the changed economic situation of the clay brick and tile industry since 2008. Finally, the situation in the fringe areas of Europe is to be investigated. With the help of this study, the clay brick and tile industry is to be put on the carbon leakage list in 2010 so that allocation can be performed with the carbon leakage factor 1 from 2013.

3 No result at Copenhagen

At the international climate protection conference in Copenhagen in December 2009, no Kyoto successor agreement could be approved. Now up to the expiry of the Kyoto Protocol at the end of 2012, work on such an agreement is to continue at full steam. For European emission trading this means that the minus 20 % goal (see figure) will not be increased to minus 30 % as planned. This would have resulted in further massive cuts in the allocation to the plant operators.