Optimal procurement of gas and electricity

on a liberalized market: How?

For some years now, it has been normal procedure among business concerns to purchase electricity from power utilities by way of competitive bidding. On the German gas market, however, that has only been possible for about a year now. For gas users to optimally exploit the opportunities offered by a liberalized market, they must know and go by the new “rules of the game” when entering into new supply agreements. This contribution illuminates the boundary conditions now prevailing on Germany‘s energy markets. Practical examples show how to be successful and secure the substantial potential savings that have now become available.

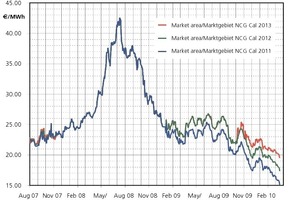

1 Market mechanisms on the German gas market

Despite the fact that the German gas market was liberalized way back in the spring of 1998, when every...