Acimac reports increase in sales for 2013 – driven by exports

those of previous year, the Italian ceramic machinery manufacturers have reconfirmed their position as a global leader. Following the drop registered in 2012, the total income registered in 2013 could be increased by 2.2%, bringing the sector back to its 2011 levels, thanks also to the increase in exports.

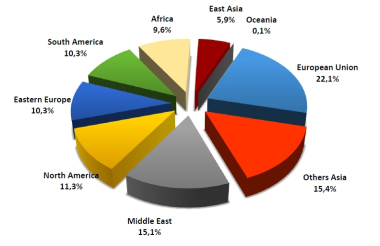

Export markets

Exports increased by 5.8% compared with 2012 and, with a sales volume of

€ 1 366.4 mill., accounted for 79.9% of the total income.

The top export destination was Asia (excluding China) with a 4-% increase on 2012. The Asian market holds a 16.2% share of the total export market (sales of € 221.3 mill). The second largest export market is the Middle East (+3.2%) with sales of € 213.7 mill., accounting for 15.6% of the total. The European Union dropped to third place with a fall of 8.9%. Africa performed extremely well (increasing sales by 17.5%, equal to € 200.1 mill), and was followed by South America (€ 182.2 mill.), Eastern Europe (€ 156.3 mill.), North America (€ 90.4 mill.) and finally Oceania(€ 0.5 mill.). Excellent results were achieved on the Chinese market, where sales could be increased by 51.6% to over € 100 mill.

Italian market

The opposite trend prevailed in the home market with sales registering a drop of 9.9% in 2013. They settled at

€ 343.8 mill., equal to 20.1% of the total sales. The decline in Italy is common to all the main branches of the ceramics industry: tiles, sanitaryware, tableware and heavy clay.

Companies and employment

In 2013, the number of ceramic machinery and equipment manufacturing companies operating in Italy fell to 144 (-7 compared to 2012). Although the whole domestic sector has been resized, it does, however, display a clear improvement in the trend of company growth. Indeed, the percentage of businesses tending to grow rose to 31%, a 10-% increase compared to the previous year. In contrast, the number of companies with diminishing or stable sales figures is decreasing.

Positive signals came on the employment front, with the number of people employed increasing by 1.3% to a total of 6 049 (+76 compared with 2012).

Structure of the businesses

The first group of companies with a turnover up to € 2.5 mill. remains stable and the biggest category overall (55% of the total). The group of companies with sales up to € 10 mill. also remained stable, while the biggest fall was experienced in that of companies with turnovers of up to € 5 mill., which dropped by 5 to 28 companies. A slight decrease was also experienced in the group of companies with sales of € 10 mill. or more.

Customer sectors

The division of the sales by customer sectors is almost the same as that of previous years, regardless of the significant changes which have taken place in the turnover of some industries.

A curbed trend was experienced in the second largest customer sector, machinery and plants for clay brick and roofing industry, which fell by 8.6%. In 2013 the turnover generated in this segment was € 133 mill., 7.8% of the total sales. This was mostly the result of income from foreign sales (90.7%). Regardless of its weight overall, the export market continued its decline (-5.3%), even if this was much less pronounced than that in the home market (-32%).

Types of machinery

The shares of income generated by the sale of the various types of machinery has not undergone substantial changes compared with the previous years.

Machines for shaping ceramic materials are still the top type of machinery sold, the sales accounting for 25.2% of the overall turnover. Next come raw materials preparation machinery (14.4% of the total), kilns (10.5%) and machinery for storing and handling (9.2%). In fifth place, separated from the other decoration technologies for the first time, were digital decoration machines, which saw an increase of 10% on their 2012 figure and which account for 8.5% of the total. These are followed by finishing technologies (7.3%), glazing and traditional decoration (7%).

Overall, during 2013, as well as those achieved by the shaping machines (+30.3%), the best results were achieved by clay preparation machinery (+28.2%), and machines for picking, packaging and palletizing (+17.6%). Important increases were also registered in the sale of laboratory instruments (+47.9%), even this has a limited influence on the turnover overall. Other types of machinery registered more moderate variations: +2.1% moulds, +9.7% purification, +9.9% digital decoration.

In contrast, glazing and traditional decoration are both in decline (-34.2%). Sales of quality and process control systems (-82.9%), engineering (-46.7%), drying systems (-27.6%) and storage and handling machines (-15.3%) also experienced a fall.

One interesting aspect is the difference between the most popular machines sold in Italy and abroad. On the domestic market, the largest share of the overall turnover was generated by sales of technologies for shaping, finishing and moulding. In other countries, the top technologies sold were those for shaping, raw material preparation and firing.