Italy‘s heavy clay industry enduring major crisis

On 19 and 20 June 2014, Naples was host to a joint annual meeting of the European (TBE) and Italian (Andil) Roof Tile and Manufacturers Associations. The event included presentation of the Italian brick and tile industry‘s latest statistical data.

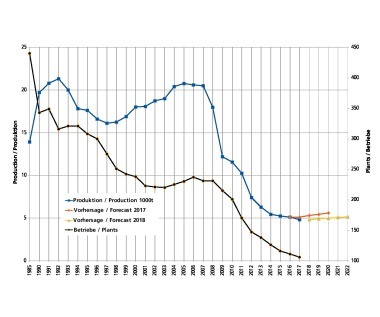

Andil has been systematically collecting and analysing the brick and tile industry‘s production data since 1985. »1 reviews the historical data through 2013 (Andil: green curve) and tacks on a forecast for the years 2014 through 2016 (blue curve) published by economic research institute Cresme [1]. No crisis equal to what the heavy clay sector has...