Solid results for first half of 2020 despite Corona

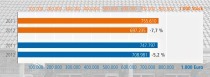

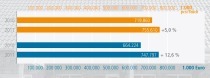

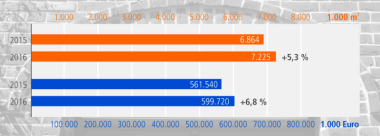

The German brick and tile industry can look back on largely positive results for the first six months of 2020. According to details released by Germany’s Federal Statistical Office, the value of production for masonry bricks increased by 3.2 percent from January to June 2020. While backing bricks report a slight plus of 0.4 percent, the demand for pavers for flooring and road surfacing has increased by 5.9 percent. The driver behind this positive development was again facing bricks with 7.7-percent growth. Even the roofing tile segment, which has battled with some losses in recent years, was able to improve slightly by 0.4 percent.

“Even under the difficult Corona conditions, clay brick has asserted its position as market leader among the wall construction materials. In view of the restrictions, it is, however, questionable whether this positive trend will continue in the second half of the year,” comments Dr Matthias Frederichs, General Secretary of the Federal Association of the German Brick and Tile Industry. “Looking at the medium-term perspective, it is also still completely unclear what impact the EU’s tightening of climate policy in September will have on industry in Germany. Nevertheless, the figures for our industry, especially the positive developments for facing bricks and clinker bricks are particularly gratifying. The current trend towards long-life brick facades has been reconfirmed.”

Better support

The slight plus in sales in the roofing tiles segment probably has something to do with the much improved support and increased subsidies for energy-focussed building renovation. On account of their optimal roof inclination, pitched roofs offer great energy saving potential and are therefore a popular starting point for minimizing energy consumption.

Looking ahead, the Federal Association of the German Brick and Tile Industry expects a further expansion of the support policies to encourage energy-focussed building renovation. “From 2021, this will give urgently needed impetus to the so far neglected renovation of building stock,” explains Frederichs. With the increase in the roof renovation rate from 1.3 percent at present to 2 percent, around 94 million tonnes CO2 could be saved by 2050.