“As a specialised manufacturer of a manageable size,

we have all the better opportunities“

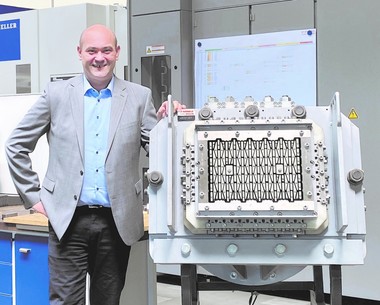

For die manufacturer ZMB Braun in Friedrichshafen, Germany, a subsidiary of Händle GmbH in Mühlacker, the year 2024 was anything but ordinary. In March, the company had to file for insolvency. However, as early as autumn the creditors‘ meeting approved the insolvency plan - a few weeks later, the proceedings were officially terminated. What was going on at Lake Constance? This question intrigued the editorial team of ZI. In an interview, Händle and ZMB BRAUN Managing Director Andreas Treut and ZMB Braun plant manager Markus Selbach explain why market leadership does not automatically equal market success, how restructuring can be achieved quickly and successfully, and why dies for the brick and tile industry are still a market with a future.

About ZMB Braun and the reasons for its insolvency

ZMB Braun manufactures dies for the brick and tile industry, doesn‘t it?

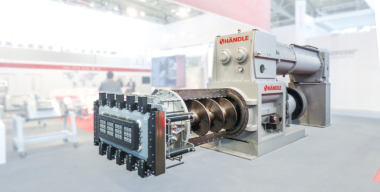

Markus Selbach: Our product range is much more comprehensive. We supply complete solutions for shaping extruded columns. These include not only dies, but also special cleaning devices, quick-change systems and hydraulic devices for switching from one die to another within a few minutes.

We offer this system for all types of bricks, facing bricks, backing bricks, roof tiles, pavers and specially shaped bricks. Our solutions are also used in technical ceramics and cement extrusion. This extensive experience characterises us. All our customers benefit from this comprehensive expertise.

Andreas Treut: ZMB Braun is the largest die manufacturer in Europe and, as far as I know, the only one in the world with a closed process chain for high-quality dies through to chrome plating and final assembly. Hard chrome plating is crucial for the quality of our dies.

MS: Our in-house chrome plating facility offers our customers several advantages. In contrast to external service providers, who chrome-plate a wide variety of components, our experts specialise in dies, liners and core bars. This pays off: The costs are only around a third of the usual market prices. At the same time, we can react flexibly and at short notice to enquiries and emergencies - a real advantage for our customers.

According to the press release, the insolvency was preceded by a months-long slump in sales caused by the collapse in demand for residential construction products. Please explain the connection.

AT: The market for dies is dependent on direct demand from brick manufacturers. Unless new products are developed, demand is actually only for replacing worn-out products and thus parallel to brick sales. In ZMB Braun‘s main market, the German-speaking region comprising Germany, Switzerland and Austria (GSA), brick manufacturers have reduced their production by around half over the past three years.

Was it not possible to compensate with sales increases in other regions?

AT: For a long time, we assumed that ZMB Braun dies - like Händle extruders - would be in demand worldwide. But in many regions of the world, bricks with simpler perforation patterns are produced. Our high-quality dies are too complex for such applications - and the labour costs at the Friedrichshafen site are too high to be competitive. The few companies worldwide that actually produce sophisticated and intricately shaped bricks purchase their dies from ZMB Braun - but the sales volume that can be achieved with them is not sufficient to speak of a global market.

Did Händle take over ZMB Braun in 2013 with the global market in mind?

AT: The decisive factor was our firm belief that an integrated aggregate system offers the greatest customer benefit. An extruder without a die is only half the story - a complete system only emerges in combination with the right die and pressure head. It is precisely this holistic approach that is one of our greatest strengths. With the help of our ESM extruder simulation model, we can simulate the optimum combination of extruder and die in the Händle laboratory based on the customer-specific starting material. The result can then be scaled up to a real, marketable system.

Restructuring and staff reductions

How relevant to the restructuring were the 20 redundancies and the adjustments to the process structure announced in the press release of 27 March 2024?

AT: In a restructuring programme, you have to consider which core processes are essential for the company‘s tasks. Everything that is not directly relevant can be made more flexible, reorganised - or systematically eliminated. If the workforce is reduced, there will inevitably be gaps in the processes. The process structure must therefore be adapted accordingly. Today, sales, design and production control work in a shared open-plan office - with short distances and efficiently linked process chains. The teams now work in parallel and closely interlinked, instead of one after the other as in the past. This requires more personal responsibility and cross-divisional thinking - but that is precisely what makes us faster, more flexible and fit for the future.

MS: We have specifically broadened the qualifications of our employees. In the past, many were specialised in individual activities such as milling, turning, welding or sheet metal processing. Today, our skilled workers can be deployed much more flexibly: an employee from the electroplating department can provide support in core bar construction, assembly or dispatch if required - and vice versa. Instead of traditional departments and rigid responsibilities, there is now a joint production team. Everyone helps everyone else, and collaboration works across departments - efficiently, collegially and with a common goal.

↓

How have the employees responded to this expansion and flexibilisation?

MS: The willingness to change naturally depends on the type of employee. Many employees really appreciate the expanded range of tasks and the greater variety. For some, the change was unfamiliar at first - but we accompanied them carefully and, I believe, integrated them well into the change process.

AT: Nobody wants to return to the old system today. The changeover has made us noticeably more flexible and agile as a company - and nobody wants to miss out on this progress.

MS: This also applies to the entire group across all companies. ZMB Braun works closely with the parent company Händle. For example, if someone is on holiday with us, tasks such as drawing up delivery documents or customs clearance can be taken over by Händle. These synergies create additional security - and therefore real added value for our customers.

Were the redundancies organised in a socially responsible way?

AT: The decision to cut jobs was extremely difficult. As part of the self-administration process, we did everything we could to make this process as socially acceptable as possible.

First of all, the management, together with the works council and the trade union, had to agree on a viable business plan and a long-term perspective for the company - otherwise the company runs the risk of entering regular insolvency.

On this basis, a joint decision was made as to which employees would have to leave the company. Not only qualifications, but above all social criteria were decisive. In some cases, this meant training employees with special protection against dismissal for new tasks. Thanks to the transfer company, we were able to guarantee the colleagues affected 80% of their last salary for twelve months. Some used this as a smooth transition into retirement, others were quickly placed again with the support of the employment agency - not least because they were almost exclusively highly qualified specialists.

MS: As far as I know, everyone who wanted to continue working has since found a job again. Of course, there was a lot of disappointment at first - but the relationship with our former employees is still good. Some of the colleagues who have retired even say today: “Nothing better could have happened to us.“

AT: I can sleep well today because we implemented the restructuring together and by mutual agreement, and were able to secure around 30 jobs in the long term. There was no other way, but we managed it well. This is also confirmed by our lawyer Luther from Stuttgart: successful restructuring in less than nine months is only achieved in five per cent of all insolvency proceedings.

Goals and markets

Following the restructuring, is ZMB Braun now better prepared for future risks such as falling demand and sales?

AT: The new business model is based on a 50 per cent reduction in sales in the GSA region. We assume that we are currently experiencing the low point. ZMB Braun is prepared for this situation and is currently just covering its costs. If there is a slight upturn in the industry, our situation will also improve immediately. Globalisation also offers opportunities for ZMB Braun - particularly in the field of engineering developments and, to some extent, in production. As a result, we can now look ahead strategically and grow step by step.

MS: The current capacity utilisation is very good - overall, we see no cause for concern for the year 2025.

What are the goals for the company‘s future development?

AT: Firstly, we will focus ZMB Braun even more strongly on the core European market. When the market picks up again, we will be ideally prepared with our high-quality die systems.

Secondly, we will continue to target the global market for high-quality dies. The demand for higher-quality products - such as static and insulating bricks - is growing noticeably, even outside of Central Europe. Efficiency is playing an increasingly important role here. If three bricks can be shaped from the same processed material instead of one, this not only saves material but also energy. Even in energy-rich regions, energy efficiency is becoming increasingly important.

Thirdly, thanks to our group of companies - Steele, Händle, ZMB Braun, Direxa and our subsidiaries in Eastern Europe - we can also produce simple dies at competitive costs and thus meet the corresponding demand worldwide.

A current example: Händle has received new orders in the Arab world, for example in Iraq. They are also interested in our energy-efficient drives. Thanks to the network, we can integrate suitable and efficiency-enhancing dies from ZMB Braun directly into these systems. The positive customer feedback shows this: The added value of our integrated solutions is recognised and appreciated.

MS: We are also experiencing the growing importance of energy efficiency on a smaller scale at ZMB Braun. One example: there is a very complicated die for ceramic honeycomb bodies for the production of catalytic converters. The customer could produce it in their own tool shop, but prefers to order it from us. This is because our die requires 150 bar pressure and his own 180 bar. This reduces wear, saves energy and lowers operating costs.

Another of our strategic corporate goals is to meet the international demand for high-quality dies, particularly beyond heavy clay ceramics. We are not limiting ourselves to clay. There is a wide range of materials that can be extruded, and we have already built suitable dies for almost all of them. We also co-operate with research institutes to drive innovation and develop new applications.

What are the prospects on the international markets?

MS: In the field of technical ceramics, complex dies are in demand from a Chinese manufacturer of honeycomb bodies. In the field of heavy clay ceramics, a customer in South Korea is producing high-quality split tiles. In Saudi Arabia, our solutions are used in the production of horizontally perforated bricks.

AT: In technical ceramics, niche applications are currently the most relevant for us. A few years ago, there were brief signs of a large market - equipping ocean-going vessels with diesel soot filters seemed very promising. Today, the shipping industry is increasingly focussing on primary emission avoidance instead of exhaust gas purification. As a result, no market has emerged.

So will you continue to focus on the heavy clay industry?

AT: ZMB Braun will remain clearly focussed on heavy clay ceramics. From a global perspective, clay, together with concrete, is the most important building material and will remain so in the long run. In the long term, we have good opportunities in clay on the global market. Problems can only occur temporarily in regional markets. For this reason, we are focussing on the international orientation of the group of companies together with Steele.

Because wherever the population is growing rapidly and new living space is needed, new markets are emerging for us. Especially where clay is a traditional or essential building material due to a shortage of wood. Babylon and Mesopotamia are historical examples of this, and today‘s Arab markets with their population growth are current examples. In these markets, both Händle and ZMB Braun can grow successfully with dies adapted to the market. And the higher the demands on the end product, the better the opportunities for ZMB Braun. This is because we are observing a gradual but steady change worldwide towards more efficient production processes and higher product quality - a trend that is precisely in line with our strengths.

MS: Here in Germany, there is a considerable backlog in residential construction. For years, we have been falling short of the targets we have set ourselves for new construction. Sooner or later, housing construction will have to pick up again here too. There is no other way. People need living space.

AT: I often think of a quote from our former colleague Willi Bender, who wrote in his book “From Brick God to Industrial Electronics Engineer” that brick products have been “manufactured for almost ten thousand years”. I am sure that this will remain the case for the next thousand years. The important thing is that we adapt to the circumstances. That is what we have done at ZMB Braun. The brick industry remains a market of the future. As a specialised manufacturer of a manageable size, we have all the better opportunities.

We would like to thank all our customers for their loyalty and support in these challenging times.We are working nonstop to overcome the final after-effects of the insolvency - and want to remain a reliable and strong partner for our customers. Together with our customers, we will also master the current construction crisis.