Further decline in production and demand for bricks in 2024

The pressure on the housing market remained unabated in 2024. Due to political stagnation but also high financing costs, personnel shortages and lengthy procedures, realizing 900,000 new housing units until 2030 is increasingly out of reach. Furthermore, legally tenable solutions to the nitrogen challenge are still lacking, now complemented by a lack of sufficient new power and water connections.

The Centraal Bureau voor de Statistiek (CBS) recorded the completion of over 69,000 new homes. This is down from 73,650 in 2023 (minus 5.5 percent) and appears to be due to low permit issuances in 2022 and 2023. Due to subdivision, transformation, amalgamation and demolition, no more than over 1,000 new housing units were added to the stock. The number of permits for new flats rose to 67,000 (plus 21 percent, CBS). This is surprising given the new Environment Act inured in early 2024 but also a compliment to municipalities for still being able to keep the issuance level. Almost the same number of permits were issued for new homes for sale and rental: 34,000 for sale (plus 28 percent) and 33,000 for rental (plus 16 percent). Relevantly, the average number of flats per permit granted rose to 10, almost double compared to 2016!

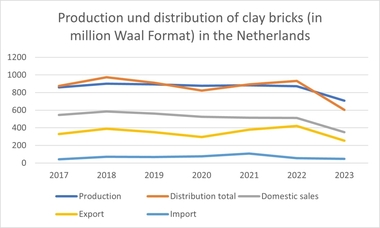

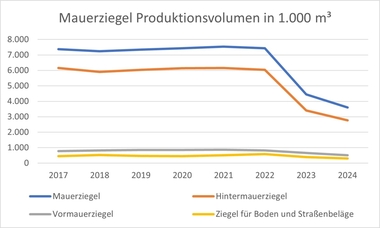

Masonry brick

After a very poor 2023, masonry brick sales declined further in 2024 (minus 7 percent): a new historic low. The sales decline was both domestic (minus 9 percent) and foreign (minus 4 percent). It is assumed that much of the domestic consumption was achieved with bricks from the stock of the intermediate trade. In order to control yards stockpiling, the brakes were applied sharply to production (minus 22 percent). On a positive note, during 2024 sales picked up and production increased somewhat.

Paving brick

The paving brick market showed signs of recovery in 2024 with a need for circular solutions that has become structural. Paving brick meets this need perfectly well. The product has an exceptionally long lifetime (approx. 135 years) and a reuse rate of almost 90 percent. Customers recognize this added value and appreciate the favorable environmental costs. Product innovations through dematerialization increase customers’ choice of circular solutions with paving bricks.

Ceramic roof tiles

In 2024, demand from new construction for ceramic tiles declined further. The grades used mainly in the renovation market are holding up well. In that market there is hardly any drop in demand.

Ceramic tiles

2024 showed a stabilizing market with little new construction. The focus was on the renovation sector in which ceramic tile sales grew. Sustainability and prefabrication gaining importance, energy (prices) and labor market tightness led to higher production costs.

Expectations

According to Construction Minister Keijzer, the policy goal of 100,000 new homes by 2029 is a reality. This does require a sustained commitment from all construction parties. Nationally, there are sufficient building plans so that especially the number of building permits issued must increase. New is the government policy aimed at deregulation and simplification of building policy: STOER (Schrappen Tegenstrijdige en Overbodige Eisen en Regelgeving - Deleting Conflicting and Redundant Requirements and Regulations). This seems necessary too: the housing pipeline is increasingly filling up (plus 13 percent to 200,000 units) with licensed but not yet built homes. Against this background, sales forecasts for ceramic building products are positive in the medium and longer term.